HOW MUCH DOES IT COST TO UPGRADE FROM HDB TO CONDO ?

It is the dream of so many Singaporeans to own a condo.

Maybe it is to upgrade their social class or to enjoy the facilities provided in a condo, or to be in the plans of future capital gain, these motives have encouraged many to join in the process of upgrading from a HDB to a condo.

To start, maybe you have saved for a long time, and is now ready to buy a condo. But do you know how much it cost to upgrade from HDB to condo?

Before we look at cost, we must decide on which way you want to take to buy a condo

1) Sell off your HDB first, then buy a condo. This way is clean, it means you will remain as owner of 1 property, and get better LTV.

2) Buy a condo first, then decide on whether to sell or keep HDB. This means you become a second property owner. Your LTV will be reduced and you are also subjected to ABSD.

You must be adequately well financed with CASH, if you choose the second option.

Also do get Approval in Principle from a bank, to find out how much you can borrow before you sign the option to buy a new property.

For cost, we first look at down payment when you book a condo. This absolute amount of 5% must be paid in cash. For the remaining you may consider a bank loan. The current law states that you can only get a maximum (LTV) loan to value of 75% if you are borrowing for your first housing loan.

Which means, you must have 25% in cash or CPF, or a combination of both, to pay the purchase price.

• 1st 5% booking in cash

• 2nd 15% to be paid when you exercise the Sales & Purchase agreement

• 3rd 5% is to be paid during progressive payment stage 1, after piling is completed.

Example : If you are buying a 3 bedroom unit in OCR for $1,500,000

• LTV 75% = $1,125,000, the max amount you can borrow from bank

• Remaining $375,000, you may use $300,000 from CPF and balance $75,000 in cash.

Do note that this example is based on 1st housing loan. That means you have to pay off all existing loan from your current HDB, before you start to buy a condo. If not, you will only be able to get a LTV of 45% for second property.

Which means you need to have 55% in cash or CPF, or for a $1.5mil property you need to have $825,000, this could be tall order for some.

By the way, all deposits must be from savings , you cannot take a loan to pay for deposits under MAS guidelines notice 632.

STAMP DUTIES

Besides setting aside the cash for the initial 25% of property price, you must also have cash to pay stamp duties.

There are 2 stamp duties involved

1) Buyer stamp duties. Buyer Stamp Duty is a tax paid on documents signed when you buy a property in Singapore. Buyer Stamp Duty is computed based on the purchase price or market value of the property (whichever is the higher amount). From 20 Feb 2018, the rate is revised to 4% for property above $1 million. So for your $1.5 million property the tax would be $44,600.

Calculated as below:

a. $180,000 x 1% = $1,800

b. $180,000 x 2% = $3,600

c. $640,000 x 3% = $19,200

d. $500,000 x 4% = $20,000

2) Additional Buyer Stamp Duties is also computed based on the purchase price or the market value of the property (whichever is the higher amount).

The ABSD liability or rates is dependent on profile of the buyer as at the date of purchase of the residential property:

• Is the buyer a company entity or an individual

• What is the residency status of the buyer

• The number of residential properties owned by the buyer

In this case, if the buyer did not clear or pay off his existing HDB loans, then he will be classified as second property owner which means ABSD of 12% applies.

For a $1.5 million property the ABSD would be $180,000. You may get reimbursement for the ABSD if you sell your flat within six months of purchasing the condo.

You need to pay this ABSD in cash first, within 2 weeks of exercising the sale and purchase agreement. Hence you must set aside this cash when you purchase a condo before selling your HDB.

Other Costs involved.

There are some other costs involved after paying all the taxes.

If you are buying a resale condo, then you need to pay for the valuation of your property, estimated at $500. There is no valuation costs if you are buying a new launch condo, as the bank will accept the developers valuation.

Legal fees or conveyancing fees is applicable for purchase of property. It may range from $2,500 to $3,000. It can be paid with CPF, depending on law firm. You need not use the law firm chosen by bank if you can get a better deal from another law firm.

Ongoing Fees and monthly instalments and Property Tax

All condo owners must pay condo maintenance fees, collected by the MCST of the condo. This is higher than HDB cost, most mass market condos charge around $350 per month, but some higher end condos can charge $700 to $1000 for maintenance.

This maintenance fee is normally collected quarterly, so as an owner, you may get a bill of $1,200 for a quarter and this must be paid in a month. (there’s an interest rate charge for late payment).

Monthly instalments or loan repayment, can be quite high each month.

This instalment can be paid by a combination of CPF and CASH.

So in our example , assuming you get the 75% LTV, for a 25 year loan, your monthly instalment would be $4,768

Property tax is calculated based on the Annual Value (AV) of your condo unit. This AV value is assessed by the Inland Revenue Authority of Singapore (IRAS), it is the estimated amount of rental income your condo could have generated in a year.

You can use the IRAS calculator to determine your property tax.

In this example , your 3bed, $1,500,000 property would get an AV of $48,000, then the calculated property tax will be

• Owner occupied unit would be $1,600 or $133 / month

• Rented out unit would be $5,220 or $435 / month

Lastly, you may also want to renovate the condo, especially if you buy a resale condo instead of a brand new launch condo.

Typically, most renovation jobs would be from $30k to $60K. and most interior décor designers will take the $30,000 cap for renovation loans when they quote jobs. We assume you take a $30k loan for the renovation, the interest rate is usually in the range of 3% over a 5 year loan tenure. Monthly repayment would be $575 per month.

You have to manage all these cash outlay, and weigh into the cost of upgrading from HDB to condo.

The total cost outlay for purchasing this condo of $1,500,000 would be

- Booking deposit, 5% $75,000

- Exercise , 15% $225,000

- Progressive 5% $75,000

- BSD $44,600

- ABSD $180,000 ( can be refunded if sold HDB in 6 months )

- Valuation $500

- Legal fees $3000

- Mthly maintenance $350

- Mthly instalment $4768

- Mthly property tax $133

- Renovation loan $575

TOTAL $608,926 in CASH and CPF

CONCLUSION :

So, we have saved up for a long time and ready to buy a condo, and we have analysed and broke down the likely cost to be incurred if we are to upgrade to a condo.

As mentioned above, we have to check our financial condition if we are selling the HDB first or keeping the HDB for investment or for resale later.

Once we decided on whether to keep the HDB, we have to calculate the affordability of buying a condo based on second property status.

With the additional money needed to pay ABSD and need for more money to pay cash outfront since LTV is limited to 45%.

This will affect our calculations on affordability and loan eligibility and whether there is sufficient money to pay for this unit.

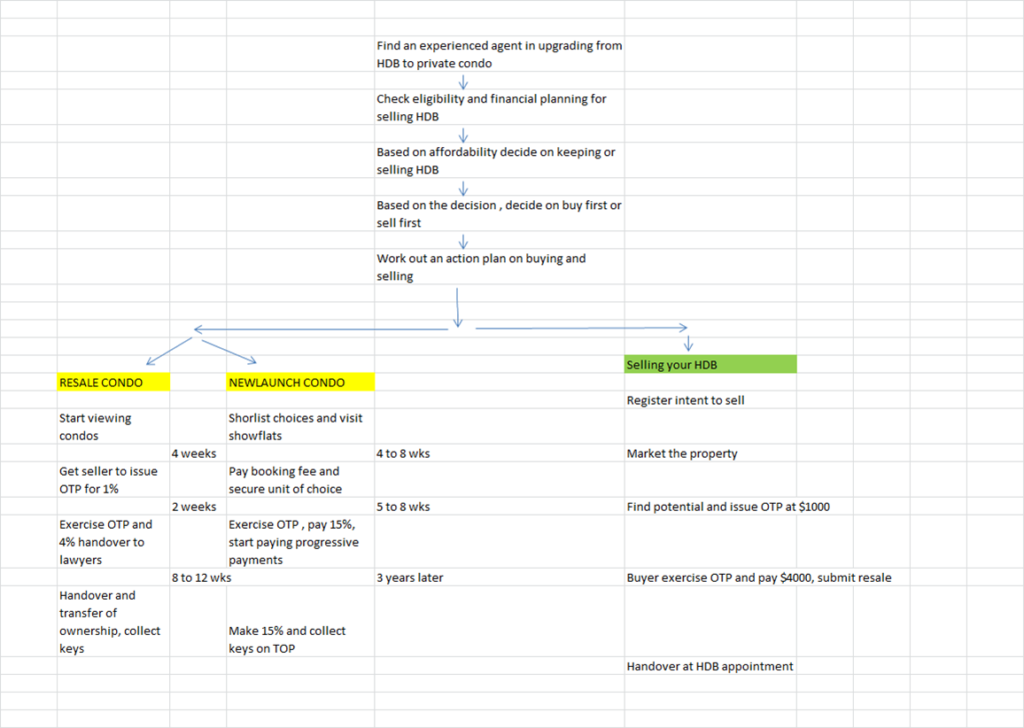

And most importantly of all, you have to decide on what type of private condo do you prefer.

A new launch condo or a resale condo, because it does affect your financial position and whether we buy a resale or a new launch condo, the timeline of our purchase varies alittle as shown in the chart above.

For more information or to learn more about the procedures to upgrade from HDB to condo, please contact Rick Fok 91092177 for a discussion.

Schedule time with me

Article by Rick Fok

Rick Fok is a realtor with OrangeTee & Tie Pte Ltd. He has been in this real estate business for 9 years. He is very focus in helping his clients rent properties and he does help many customers to buy new projects according to their needs. His interest include sports such as running and soccer besides just real estate work. He loves to connect with people to discuss properties related issues and gets enormous satisfaction in helping them fulfill their needs. If you have any queries on this topic or other , please do give Rick a call and we can discuss this over a cup of coffee.

Other Articles to read

Is it better to buy an EC than a condo ?

Buying a new launch or a resale property. Which is a better property for investment?

Do you keep or sell your HDB , when you upgrade to a condominium.