What is refinancing ? It is to get a new mortgage to replace the original mortgage.

Refinancing is basically done to allow a borrower to get a better interest rate or maybe a longer term.

In refinancing, the original loan is first paid off, then allowing the second loan to be created.

Especially for borrowers with a good credit history, it is easier for refinancing to convert maybe a variable rate mortgage into a fixed rate mortgage at a lower interest rate.

But for borrowers who had bad credit or too much debt, refinancing may be more difficult and more risky.

In a difficult economic climate or now in COVID 19 stage, if you are in financial situations, it can be difficult to make the payments or service your existing home mortgage.

Then it is the right time to do refinancing. The danger in refinancing is your ignorance, you ought to have the right advice or knowledge to do it, if not it might even hurt you more.

Most people refinance their homes when they have equity on their home. This means there is a difference between the value worth of their home and the amount owed to the mortgage.

Some things to do before you refinance your mortgage

- Know your home equity value, this can be obtain by subtracting your mortgage balance from your home’s current market value.

- Calculate your debt-to-income ratio. This can be calculated with your total debt payments divided by your total income. In Singapore, TDSR limits you to 60% of your gross income.

- Compare rates and terms. Besides the interest rates, it is very important to consider the loan duration, because a long payback period will minimize your monthly payments.

- Reduce refinancing costs. You need to know the cost in refinancing in order to compare the offer packages.

An important point to check before refinancing, is to look at the interest rate outlook. Is it going to go down further or it will climb up again soon.

Property owners who believe that rates will drop further should opt for floating interest rates or SIBOR pegged interest packages. Even if interest rates start to increase, it will take some time, and usually it will cross the usual 2 years lock-in period.

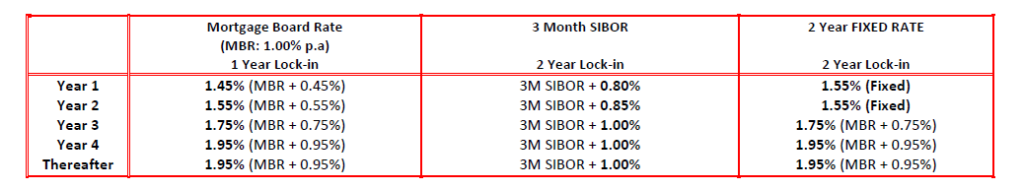

For those who prefer a fixed rate home loan, the current fixed rate is at 1.55% for a 2 year fix rate package, this is very attractive.

What Are The Advantages Of Refinancing?

Main advantage of course is reducing interest rate. This will help those who want to use the savings into some other form of investment.

It allow homeowners to stretch their current loan tenure. By refinancing you can stretch your loan tenure, although it will increase the overall cost (due to interest) but it will decrease your monthly instalment / repayment of loan.

Homeowners can refinance for different reasons including:

- Cash out home equity – Homeowners can extract equity from the homes to pay for home repairs or major home improvements or for other purchases.

- Change loan duration: This is taken to shorten duration of repayment in order to pay less interest over the life of the loan. Or to lengthen the duration of repayments to lower monthly payments.

- Lower rates: Especially now when our SIBOR is only 0.63%, declining rates is good for homeowners to refinance so as to lower their monthly loan payments.

- Change loan structure: For borrowers who used variable SIBOR rates to make initial payments more affordable could now shift to a fixed-rate loan after they built up equity & have progressed along their career path.

Example :

If your current home loan package is pegged at 2.5% interest. You might want to consider doing a refinancing.

By refinancing, you can reduce the monthly repayment amount outlay with a lower interest rate. You could achieve this by changing to another bank or simply by revising to a new loan package with the current bank.

Eg. Mr Lim has an outstanding loan of $1,000,000. Has 20 years loan remaining and his current interest rate is 2.50%. He is now paying $5,300 per month.

If he does refinancing at a loan package of 1.62% for 3 years, then his new monthly repayment will drop to $4,880 per month, that is $500 savings per month or $6000 savings a year or $18,000 savings over 3 years.

By doing so, you could save some money in the future, it could be hundreds or even thousand depending on your loan amount.

Usually, under normal circumstances, most homeowners can start to look for refinancing after 3 years. Because for most loan packages, the interest rates will increase after 3 years, or there may be some lock in periods stated in the contract.

Singapore InterBank Offered Rate (SIBOR) and Swap Offered Rate (SOR) rates, these will determine the interest rates for most home loans.

The SIBOR and SOR rates are closely monitored by The Monetary Authority of Singapore (MAS), and currently, the SIBOR is at all time low 0.63%, this makes refinancing very attractive.

When you are considering the refinance loan package, you must also consider the new lock-in period as well as other costs such as legal fees, valuations .

You can refinance at any time but subject to rules on your existing loan mortgage.

Is there any lock in period in previous contract? If there is, then you have to hold on till the lock-in expires before changing bank or loan package. This is because if you execute during a lock-in period, there will be a penalty fee of about 1.5% on your outstanding loan amount, this can be quite hefty.

Do note that you need to give at least 3 months notice to your existing financing bank before you can refinance with another bank.

As mentioned before, the other costs involved in refinance could be

- Legal fees , about $2,000 to $3,000

- Valuation fees , could range from $250 to $1,000 Pte or even higher depending on type of private housing.

- Prepayment penalties for those who did refinancing during lock in periods

Good news is that some of these cost may be subsidized by the new bank if the refinance amount is big, maybe above $500,000. But such subsidies will also include a clawback condition. This is to prevent you from refinancing again with another bank without a penalty fee. It allows the bank to claw back the subsidies that was given to you previously.

Another cost to note is the cancellation fee. This fee is impose for uncompleted or BUC properties. Because for BUC properties, the home loan amount is disbursed in stages according to progressive payment schedule, if you cancel contract, the cancellation fee is about 1.5% of the loan amount that has yet to be disbursed.

By the way, if the new loan package has a lock in period, it is important for homeowners to note that there will be penalty cost if you are to sell the property within the next few years after getting the new loan.

What Are The Risks of ReFinancing ?

One of the risks of refinancing, is the possible penalties you may incur as a result of paying down your existing mortgage.

In most mortgages, there is a condition that allows the mortgage company to charge a fee for early repayment of mortgage. This fee can amount to thousands of dollars so it is important to note that the benefits of refinancing covers the cost of penalty as well as the other additional fees such legal fees and valuation fees.

Refinancing vs Repricing

Is Refinancing The Same As Repricing? No, simply defined, refinancing involves a switch to another loan package offered by another bank. While repricing means you are taking a different loan package within the same bank.

Refinancing is simply defined as switching your mortgage loan from one bank to another. Refinancing involves higher costs. There will be legal fees and costs of valuation, although many banks will subsidise these legal and valuation fees.

Refinancing takes a longer time and it is a more tedious. You have to submit your income and debt documents, to meet the Total Debt Servicing Ratio (TDSR).

Repricing is defined as switching your mortgage loan package within the same bank. Repricing involves lesser costs. There is usually only a fixed conversion/admin fee which could range from $200 to $800.

Many mortgage loan packages come with a one-time repricing option, so that you can change without incurring much cost.

Types of mortgage rates typically offered by the banks?

Housing loan packages are very dynamic, banks will always try to create attractive packages to match the demands of consumers.

Usually a housing loan package will start with a super low rate during the first two to three years, then followed by a jump in interest rates in the subsequent years.

Fixed Rates

Fixed rate, this is typically between 1 to 5 years.

Property owners who like stability and don’t like to monitor rates will go for this. Fixed rates is usually slightly higher than floating rates, by around 0.3% interest.

For BUC projects (Building Under Construction), banks usually do not offer fixed rates. Buyers can only use SIBOR pegged rates package before switching to fixed rates after their properties are completed.

Board Rate

Before bank rates are pegged to SIBOR or FHR, the bank use their own Board Rate. This rate is fixed by banks and we do not understand how this figure is derived.

SIBOR Pegged Rate

Now many mortgage loan packages are pegged to the SIBOR.

The interest rate for these packages are made up of

SIBOR + Spread = Interest Rates

The spread is a percentage determined by banks and it is added on to the SIBOR rates to form the interest rate which property owners pay.

Example Current Scenario . SIBOR is 0.63% , Spread is 0.80%

Then the interest rates charge to customer will be 1.43%

It has been observed that historically when the SIBOR is lower, the spread will be higher.

HOME EQUITY or TERM LOAN

Another way to get cash out of your private property is by means of a home equity loan. Home Equity loan or a term loan uses the equity of property as collateral.

If your property has appreciated in value , you will be able to borrow money on the difference between the market value of your property and your existing loan.

In Singapore, only private property homeowners can get Home Equity Loan, this is not applicable to HDB property owners.

And the repayment of this home equity loan can only be done in cash, CPF is not allowed.

How much can you draw out from a Home Equity Loan?

As a general rule , you can use this calculation

Term Loan / Home Equity Loan Amount = 75% of Property Value – Outstanding Loan Amount – CPF Monies Used

By not allowing you to borrow more than 75% of your property value, the banks have a buffer against your property should your property value drop below the amount loaned.

The banks also factor in your CPF usage (with accrued interest) because this must be return to CPF account after a sale. This will bring your total eligible loan amount lower.

The maximum loan tenure for Home Equity loan is 75 years minus your current age or not more than 35 years whichever is shorter.

If you’re borrowing more than 50% of your property’s value, then Total Debt Servicing Ratio (TDSR) would apply .

To get cash out of your property with a home equity loan is a good way to get the capital you need for business or other investment purpose or to handle some financial emergency.

Home equity loan is sometimes confused with term loan. The difference between the two is that home equity loan allows you to draw money out of a fully paid property while term loan only allows you to draw from a property that has not been fully paid.

Therefore, if the value of your property has appreciated a lot, banks will be more willing to lend you more money because your home will be used as collateral for the loan.

Example :

Tom purchase a property in 2008 for $800,000, now it is worth $1,400,000.

Assuming balance loan is $400,000 and $200,000 CPF was used.

With home equity, you could borrow about 75% less remaining loan less CPF used. You could get as much as $450,000 in loan. A good sum for investment or for other use.

Good news, in view of the difficulties brought about by the COVID 19 pandemic, the Singapore government has issued this new rules

- Borrowers are not subject to TDSR and LTV limits when they refinance their loans for owner-occupied residential properties.

- Borrowers who take up home equity loans secured on their existing private residential or non-residential properties are not subject to TDSR if the LTV ratio does not exceed 50%

Now is the best possible time for you to grab a good deal from banks, to refinance your housing loan because of the current pandemic situation happening around the world.

Conclusion

So do you say Yes or No to Refinancing? I think the most important step will be to calculate how much is your new monthly instalment after taking a new package and compare it to your current monthly instalment, to see how much will you be able to save?

Or to see if extending the loan tenure, how much money you can save by paying less.

If this savings outweigh all the costs involved in refinancing, then it would be wise decision to save money.

With so many different types of rates and different packages offered by different banks, you may be overwhelmed and do not know how to proceed.

Do give me a call , 91092177, and I could assist you to work with the many bankers that have helped me in many refinancing deals.

Do fixed a e-appointment with me now.

Schedule time with meWritten by Rick Fok

Rick Fok is a realtor with OrangeTee & Tie Pte Ltd. He has been in this real estate business for 10 years. He is very focus in helping his clients rent properties and he does help many customers to buy new projects according to their needs. His interest include sports such as running and soccer besides just real estate work. He loves to connect with people to discuss properties related issues and gets enormous satisfaction in helping them fulfill their needs

If you have any queries on this topic or other , please do give Rick a call and he can arrange for a discussion over a cup of coffee.

Other Articles to read

How will COVID-19 impact Singapore’s property market and will it affect the property price.

Which is better? To engage an Exclusive agent or Multiple agents?

Howmuch does it cost to upgrade from HDB to condo?

When should I sell my Executive Condo?

Is it better to buy an EC than a condo ?

Buying a new launch or a resale property. Which is a better property for investment?

Do you keep or sell your HDB , when you upgrade to a condominium.