Executive condo was first introduced in Singapore, as a hybrid of public and private property.

It is catered to the sandwiched class whose income is not more than $16,000 (started from $12k to $14k then to $16k).

When Should You Sell Your Executive Condo (EC)? A Guide for Savvy Owners

Introduction: Deciding the Right Time to Sell

Congratulations on reaching your EC’s MOP milestone! But before rushing to list it, consider this: selling your EC is like timing the property market’s version of a smart exit strategy. Let’s break down the factors you should think about.

Market Conditions: Know When to Hold, Know When to Sell

The MOP opens the first window to sell, but waiting until your EC is fully privatized at the 10-year mark might yield higher returns. Check current supply and demand trends—are many other units up for sale? If so, waiting for the market to stabilize could work in your favor.

Neighborhood Developments: Look at the Bigger Picture

Is your area getting an upgrade with new MRT lines or amenities like Lumina Grand, where there are massive Tengah growth plans in the pipeline? These developments can significantly boost your EC’s value. Just like waiting for a new mall to open nearby, holding on a bit longer can be worth the wait.

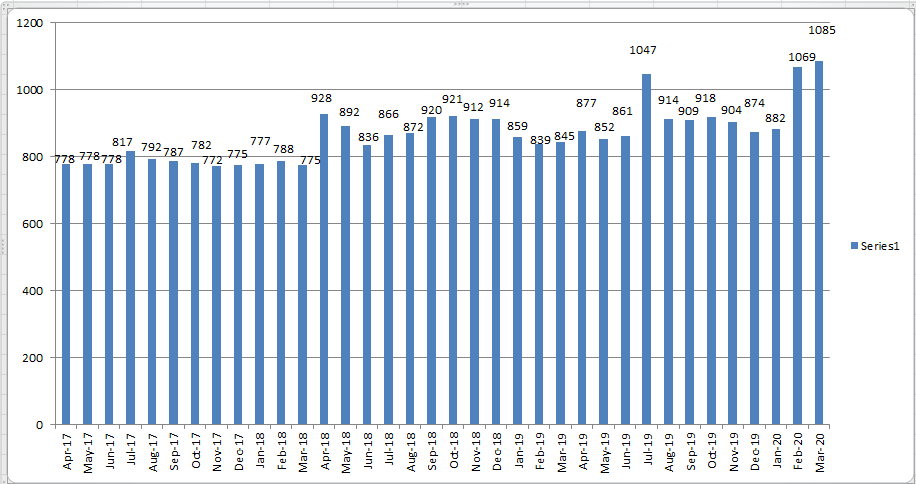

AVERAGE PRICE (PSF) OF NEW EXECUTIVE CONDOS. (Source : Squarefoot Singapore)

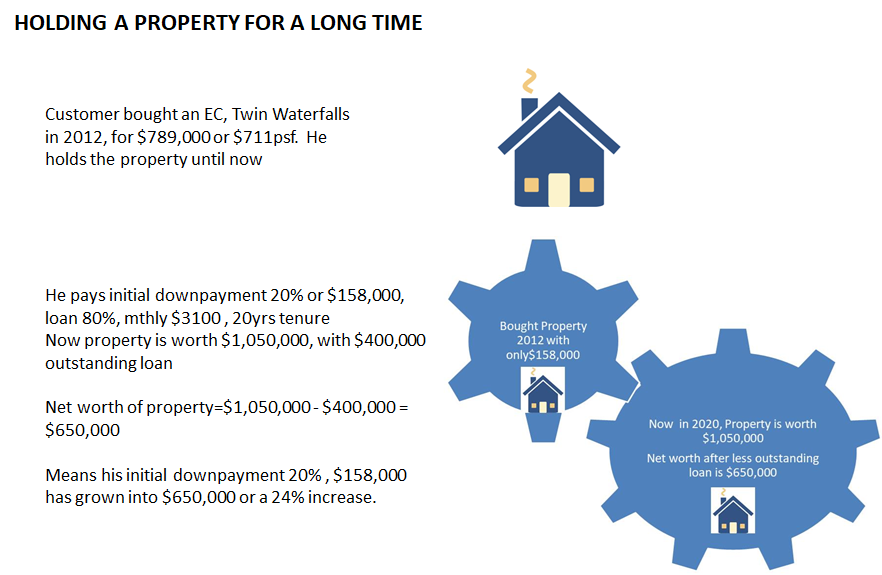

An example : If Peter , owner of an EC in Twin Waterfalls would have made at least 24% paper gain

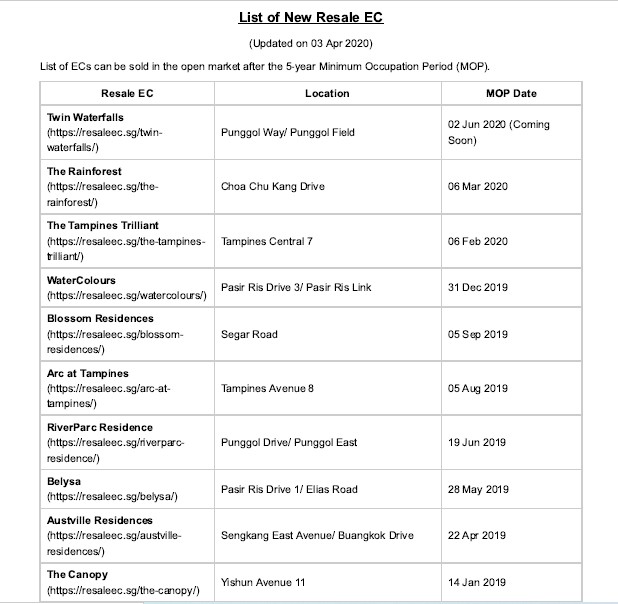

Executive condominiums (ECs) are always in hot demand, according to records many resale EC have already or almost attained their MOP.

ECs that have attained their MOP of 5 years, can now be rented out as a whole unit and also can be resold to anyone except foreigners.

Many owners who want to upgrade or to realise their paper gain , will sell their EC after MOP. At the same time, usually there is also a big pool of buyers waiting for resale ECs, since new launch EC are few and usually higher price.

These new potential buyers are also eyeing the potential when these EC reach 10 years MOP, meaning it could be sold in open market to anyone, usually also means higher capital appreciation.

With this large pool of sellers and prospective buyers of EC, we can be sure EC will be top in resale condo transactions.So if you ask when to sell your EC, this could be a good time too.

It is a good time to strategise and consider these options before acting.

CHOOSE A RIGHT STRATEGY 1) Decoupling or Part Purchase, this is done to free up one partner name to purchase another property for investment. Can be a new launch condo or a resale condo. This is recommended if you don’t intend to sell in the near future 2) Sell EC and buy another private property in a better location or buy a bigger unit with more rooms. 3) Sell EC and then downgrade to a HDB resale flat, with this option you will free up lots of cash, ideal if you are planning on retirement. 4) Sell EC and then buy another 2 condo, one under each name. You can reserve the bigger unit for own stay and use the smaller unit for investment rental income. Choose this option if you have fairly high income, (around $10k), a really comfortable budget for mortgage and at least 20 year investment horizon. As most buyers of resale property are looking for relatively younger condo, your EC after MOP is only 5 years old, it is very attractive to homebuyers, and it may fetch a better price. Because you made the right move in owning a EC, you can ride this wave and you can sell and cash out at the most optimum price at the youngest property age. But first you may need to ask yourself why you should sell right after MOP instead of waiting until full privatisation at the 10th year mark. If you are selling your EC now, you have to consider these important factors Generally, if your EC project is a large development, then there is a high chance many will want to sell when their EC reaches MOP, and cash out. Usually in such case, at the initial stage buyers will have ample choices to select and urgent sellers will likely sell cheaper to offload the unit. And after a period of 6 months or more, stabilisation will settle and the sellers subsequently will get better prices as competition thins. For private properties , they don’t need to fulfil MOP, owners can sell their property upon TOP of the project. Therefore you need to monitor the supply of newly TOP condos in your area as it will mean increasing the competition pool. Buyers will have more choices. The ideal situation for you , as a MOP EC seller, is to have a neighbourhood of old condos as well as a neighbourhood of HDB BTO flats that also just MOP five years. As HDB BTO upgraders will be looking at private condo or ECs to upgrade, this will add to demand for your resale EC , especially so as it is near or in their familiar area. Case in point: Eg. Tampines Trilliant at Tampines Ave 7, total 670 units With the help of URA Masterplan, you will be able to know what are the plans around your neighbourhood. With news such as new MRT stations, new shopping malls, or new HDB BTO nearby, it will make it easier for you to market your EC. This will also help to improve your profit margin and safeguard you against any potential downside. So, if you know that MRT takes 2 years more to complete, it might be a better bet to wait for it to complete before you sell and it would mean better selling price and better margins. Generally, in down markets, you should only sell if you’re in urgent trouble (e.g. job loss) or to capitalise on getting funds to finance your purchase of another property at a discount. ECs generally do not correct as much as private property as the fundamental reason for holding EC is for owner stay. So there is really no hurry to sell your EC, unless you want to upgrade and buy a better unit at large discounts. For example: Eg. If market is correcting at 20% So if you are holding to a EC worth about $1.25 million , you might want to sell to take advantage of a sale of a bigger unit worth $2 million but is going at $1.6 mil now. It must be clear and well thought process , with all the family needs and priorities being taken care of. If you are buying another private property, (either new launch condo or resale condo) after you sell your EC, then it is easy. But if you intend to buy another government subsidized unit, you have to wait out for another 30 months after selling your EC before you can submit a new application to buy any of the following. Need an opinion on your property investment plans, the best buys available or help marketing your properties? Get a 1-time free 30 min Property Wealth Planning consultation with Rick. Schedule one right now. A PWP consultation includes: – An in-depth financial affordability assessment and timeline planning – Highly relevant investment insights – A clear and customised investment road map – A curated list of best buys in today’s market with good growth potential & minimal risks – Selecting units with the highest potential in a new launch project – Advice on marketing and getting a buyer for your property fast

Many Yishun BTO flats in Yishun Greenwalk and Adora Green has reached MOP and many have upgraded to private homes, and The Canopy EC in Yishun is also sought by these buyers.

Many EC resale owners are asking for $1,250,000 for their 3 bedroom.

Surrounding HDB in Tampines St 71 , which is around Trilliant have seen a surge in selling too, with 4Rm transact at $450k and 5Rm at $550k

In a downturn, when prices are correcting, usually the bigger or more expensive property will correct more, as investors are likely to bail out.

When a recovery returns, you will benefit more with this new property than holding on to your existing EC through the crisis.CONCLUSION :

In conclusion, we must view MOP of EC from many angles.

It is not a magic number to say you have to sell it after 5 years MOP.

This should not be the case, we should sell the EC only based on many other reasons as discussed above. It should be base on both market fundamentals and your objective to sell.

If you have any further queries on how or when to sell your Executive Condo, you could reach me at mobile 91092177 or simply email me at rickfoknh@gmail.com.

Article contributed by Rick Fok

Rick Fok is a realtor with OrangeTee & Tie Pte Ltd. He has been in this real estate business for 9 years. He is very focus in helping his clients rent properties and he does help many customers to buy new projects according to their needs. His interest include sports such as running and soccer besides just real estate work. He loves to connect with people to discuss properties related issues and gets enormous satisfaction in helping them fulfill their needs. If you have any queries on this topic or other , please do give Rick a call and we can discuss this over a cup of coffee.

Other Articles to read

Is it better to buy an EC than a condo ?

Buying a new launch or a resale property. Which is a better property for investment?

Do you keep or sell your HDB , when you upgrade to a condominium.